Powhatan County Greenlights $4B Data Center for Newport Equities and JMS Investments

Powhatan County’s Board of Supervisors has cleared the way for a massive data center development, approving rezoning and special permits for a $3 billion to $4 billion campus proposed by Newport Equities LLC, with the property owned by JMS Investments LLC. The decision marks one of the largest private capital investments in the county’s history and underscores Virginia’s growing role as a national hub for digital infrastructure.

High-Stakes Bet on Economic Diversification

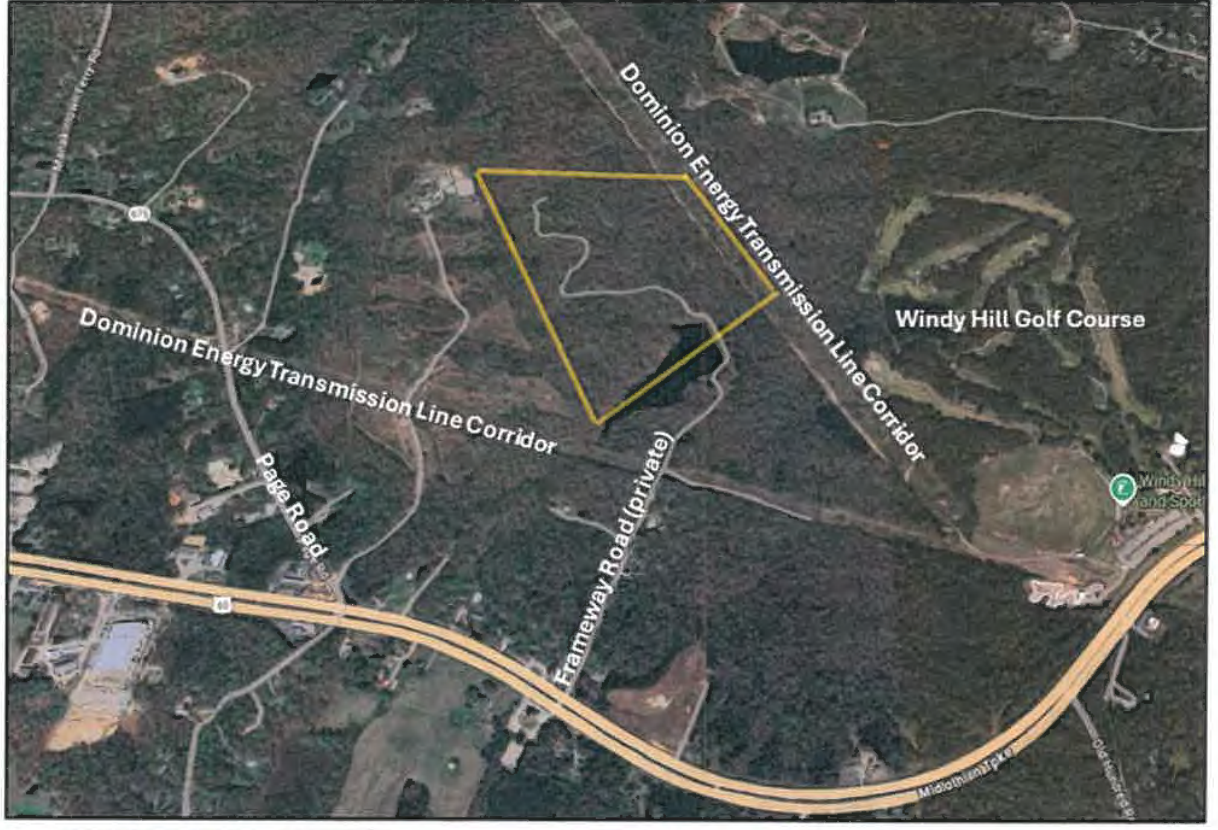

The 5-0 vote on October 27, 2025, followed months of public debate over land use, infrastructure financing, and power availability. The Board’s unanimous approval of both Ordinance 2025-31 (rezoning) and Ordinance 2025-32 (conditional use permit) allows Newport Equities to develop a 181-acre data center campus northeast of Page Road and Anderson Highway.

The site combines two parcels — a 61.8-acre tract owned by JMS Investments LLC, rezoned from Agriculture (A-10) to Light Industrial (I-1), and an adjacent 119.9-acre parcel approved in 2024. The unified campus is designed for up to four buildings totaling roughly 2 million square feet, with building heights permitted up to 75 feet, and screened rooftop equipment extending to 90 feet.

Infrastructure Challenges and Energy Load

The project will demand between 300 and 400 megawatts (MW) of power — among the largest single-user loads in Dominion Energy’s territory. Dominion, which currently serves about 3.8 GW of data center demand out of a 19.5 GW total load, issued a “will serve” letter for the adjoining site last year but won’t formalize service until construction plans are finalized.

To accommodate the project, an on-site substation consuming 7–8 acres will be built, with procurement of specialized electrical equipment expected to take five to seven years. Water use is projected at 250,000 gallons per day, supplied by the Flat Rock Area Water System — a relatively modest draw for a campus of this scale.

Public Costs and Fiscal Trade-Offs

County staff characterized the data center as a “transformational fiscal asset” with annual local revenue projected between $9.7 million and $13.8 million, and some board members projecting as high as $18 million once the site is fully operational. The investment is central to Powhatan’s strategic goal of shifting its tax base toward an 85/15 commercial-to-residential ratio.

However, the financial upside comes with trade-offs. The County estimates its composite index will rise, reducing state education aid by $1.5 million to $2.5 million annually. Powhatan will also shoulder significant upfront infrastructure costs — roughly $19 million tied to utility expansions including the Oakbridge Pump Station ($7 million) and the Dutoy Creek Wastewater Treatment Plant ($12 million). The county has indicated that Newport Equities must contribute proportionally to those upgrades before service connections are finalized.

Regulatory Path and Reversal of Denial

The project’s approval came after two rounds of Planning Commission review. On September 2, 2025, commissioners deferred the case, citing unresolved issues around buffering, traffic access, and utility cost-sharing. When the proposal returned on October 7, Planning Director Ligon Webb recommended denial, noting lingering uncertainty over developer contributions and design details. The Commission voted 5-0 to reject both the rezoning and conditional use permit.

Despite the Commission’s opposition, the Board of Supervisors advanced the project, emphasizing long-term fiscal stability and minimal traffic impacts compared with other industrial uses.

Strategic Significance

The Newport Equities project cements Powhatan’s position in Virginia’s expanding data center corridor, joining a regional network of digital infrastructure developments stretching from Henrico County to Loudoun County — the world’s largest concentration of data centers.

For JMS Investments LLC, the property owner, the approval secures a long-term, high-value asset, while Newport Equities LLC, as the applicant, will manage construction and operational development.

“This project is a cornerstone of our economic future,” one supervisor said during the meeting. “It’s the kind of investment that shifts Powhatan from being a bedroom community to a regional economic player.